In recent years, the convergence of longevity science and financial investment has reshaped the landscape of healthcare and personal wellness.

The repurposing of well-known drugs like metformin for anti-aging applications highlights a growing trend in healthcare: the shift towards preventive strategies aimed at mitigating age-related diseases before they manifest. This approach not only has the potential to improve health outcomes but also to reduce long-term healthcare costs, creating substantial economic impacts. However, the financial viability of such initiatives often clashes with the reality of funding and market readiness, particularly when the drugs involved are generic and lack patent protection.

Meanwhile, the rise of exclusive longevity clinics, offering bespoke and sometimes unproven treatments to the ultra-wealthy, paints a stark picture of current health inequities. These clinics, while driving innovation and setting trends in the luxury wellness market, also raise important questions about the accessibility of cutting-edge health technologies.

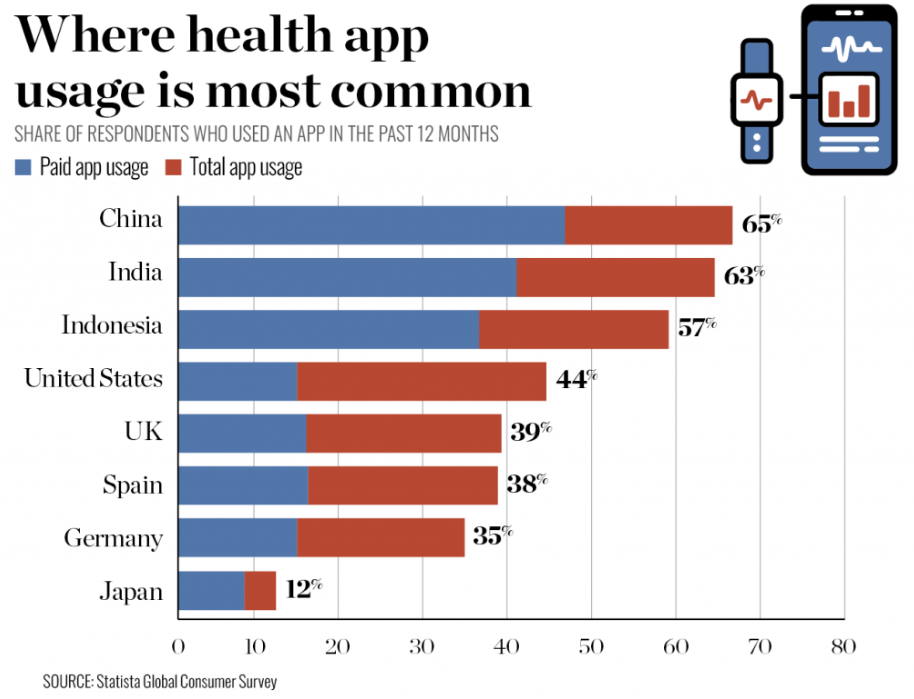

Furthermore, the broadening appeal of wellness as a lifestyle choice has catapulted the industry to a multi-trillion-dollar valuation, with technology playing a pivotal role in delivering personalized health solutions. The integration of digital tools has transformed consumer interactions with health services, making wellness a daily, data-driven pursuit. This trend towards digitalization and personalization in health and wellness opens new avenues for investment but also requires careful consideration of consumer privacy, data security, and the potential for market saturation.

We aim to explore these themes in detail, offering insights into the current state and future directions of the longevity industry.

A drug taken by millions to control diabetes may do more than lower blood sugar

Metformin, traditionally used for managing diabetes, is now being investigated for its potential to slow aging. This interest is anchored in its well-documented effects on blood sugar levels and emerging evidence suggesting benefits against age-related diseases such as cardiovascular issues, cancer, and cognitive decline.

The TAME (Targeting Aging with Metformin) Trial, a pivotal study involving 3,000 older adults, is set to test whether metformin can extend healthspan by preventing these diseases.

The implications of this trial extend beyond medical curiosity into substantial financial opportunities and challenges. As a generic, low-cost medication, metformin is accessible, which contrasts sharply with many high-cost treatments in the biotechnology sector. This accessibility could disrupt traditional pharmaceutical models by providing a cost-effective solution to aging, potentially reducing long-term healthcare costs.

However, the generic status of metformin also poses a unique challenge as it lacks the patent protection that often drives pharmaceutical investments, making funding for extensive studies like TAME more difficult to secure.

NPR

If successful, metformin could become part of a preventative health regimen recommended for the aging population, significantly expanding its current market. This expansion could prompt shifts in healthcare practices towards prevention, potentially saving on costs associated with treating chronic diseases at later stages.

Moreover, the study could pave the way for regulatory changes. Currently, aging is not recognized as a disease by regulatory bodies, limiting the pharmaceutical industry’s ability to pursue aging-related claims. Success in the TAME Trial could influence policy changes, allowing for new claims and indications for existing drugs, thereby creating new market opportunities.

From a market dynamics perspective, metformin’s success could encourage pharmaceutical companies to invest in similar repurposing strategies for other generic drugs, which could be a less costly and faster alternative to developing new drugs from scratch. Additionally, the broad applicability of metformin for potentially all aging adults presents a unique scalability that is rare in the pharmaceutical industry.

In conclusion, the TAME Trial not only explores metformin’s potential to combat aging but also tests a new model of drug development that could have far-reaching implications for healthcare economics and investment strategies in the pharmaceutical and healthcare industries.

Read the full article here.

The world’s ‘top 6’ longevity clinics destinations

Longevity clinics offering bespoke anti-aging therapies have burgeoned into a lucrative niche within the wellness industry, catering predominantly to the affluent.

These clinics, exemplified by destinations like RoseBar at Six Senses Ibiza and Clinique La Prairie, provide a range of services from genetic testing and IV therapies to personalized wellness plans, commanding fees upwards of $50,000 per week. This trend underscores a significant shift in how health and aging are approached at the highest echelons of society, turning the pursuit of longevity into a luxury commodity.

The market for these exclusive clinics is driven by several factors. Firstly, the rising global wealth and the increasing number of ultra-wealthy individuals create a growing customer base for luxury health services. Secondly, the cultural shift towards preventive health care and personalized medicine has fueled demand for more tailored health solutions that promise not just longer life, but better quality life.

The clinics’ offerings are often at the cutting edge of medical science, incorporating the latest research from genomics and biotechnology to provide treatments that are not only bespoke but also based on the latest scientific findings.

Business Insider

These clinics represent a dual-edged sword. On one hand, they generate significant revenue and can be immensely profitable due to their high service charges and the high margins on luxury health products. On the other hand, they highlight and possibly exacerbate health inequities, as such sophisticated treatments are beyond the reach of the average person. This disparity raises ethical questions about the commodification of longevity and the potential for a societal divide where only the wealthy can afford to extend their lives.

Ultimately, while longevity clinics currently serve a niche market, their existence and popularity could spur innovations that trickle down to more accessible healthcare solutions.

Read the full article here.

Health is wealth

With a projected market valuation of $7 trillion by 2025, wellness has evolved from niche luxury services to a mainstream, integral part of everyday life, driven by advances in technology and increasing health awareness.

Tech entrepreneur Bryan Johnson exemplifies the extreme measures some individuals are willing to undertake to reverse the aging process. His regimen, costing $2 million per year, includes over 100 daily supplements and advanced biometric monitoring, demonstrating the high-end potential of the longevity market. This example serves as a beacon for the kind of personalized, data-driven health solutions that are becoming increasingly popular among the affluent.

This surge in wellness interest is backed by significant financial investment and consumer spending. High-end products like Johnson’s regimen signify a larger trend where health and longevity are seen not only as medical outcomes but also as symbols of status and personal achievement. The growing financial investment in longevity, highlighted by figures like Jeff Bezos and Peter Thiel, further underscores the market’s potential. These investments reflect a belief in the eventual commercial viability of reversing aging, a concept once considered purely speculative.

World Finance

The wellness industry’s expansion is facilitated by digital technology, which has transformed health products and services into highly personalized experiences.

Wearable fitness trackers, personalized meal kits, and on-demand fitness services have all seen explosive growth, particularly in the wake of the COVID-19 pandemic. This period accelerated digital integration into everyday health management, making wellness both more accessible and more ingrained in consumer lifestyles.

However, the article also touches on the economic and ethical implications of this boom. The high cost of top-tier wellness products and services poses questions about accessibility and equity. While the wealthy may benefit from cutting-edge health innovations, the average consumer faces a market full of unregulated and often expensive wellness products that may offer little real benefit.

The wellness industry represents a robust market with diverse opportunities ranging from tech startups to established health and fitness companies. Yet, we must navigate a landscape where public sentiment and regulatory changes could shift rapidly, affecting the viability of wellness as a luxury and its integration into mainstream healthcare.

This dynamic sector promises continued growth and innovation, but with the caveat that as health becomes increasingly commodified, the industry must address the widening gap between those who can afford to buy longevity and those for whom wellness remains a luxury out of reach.

Read the full article here.

Final Thoughts

The key takeaways from the discussions on metformin’s repurposing, luxury longevity clinics, and the booming wellness market reveal both the immense potential and the inherent challenges of investing in longevity.

Firstly, the TAME Trial’s investigation into metformin for anti-aging purposes underscores a broader trend: the potential of pharmaceutical repurposing as a cost-effective strategy to accelerate therapeutic advances. This signals an opportunity to fund projects that leverage existing drugs for new applications, especially in preventive healthcare.

However, the financing challenge highlighted by metformin’s generic status points to the need for innovative investment structures. Public-private partnerships and venture philanthropy could play crucial roles in bridging funding gaps for trials involving generic medications. Furthermore, success in these trials could pave the way for regulatory changes that might expand the market for aging-related therapies, providing a long-term boon for investors who enter early.

The analysis of exclusive longevity clinics brings to light the disparities in access to advanced health technologies. While these clinics are profitable and drive forward the envelope of what’s possible in personalized medicine, they also reflect a growing market divide.

Moreover, the burgeoning wellness industry, fueled by advances in technology and shifts in consumer behavior, presents vast opportunities in digital health and personalized wellness products. We should consider the scalability of digital health solutions and the integration of AI to personalize healthcare.

The longevity sector invites investors to not only capitalize on emerging trends but also to contribute to shaping a future where healthspan extension is accessible and beneficial across different layers of society.

“Aging is the single biggest risk factor for virtually every significant human disease.”

Dr. David Sinclair

Top Longevity Reads

- Three Levers to Longevity in VC (Medium)

- The Future of the Longevity Financial Industry (Margaretta Colangelo – LinkedIn)

- Extended longevity creates investment opportunities (Business Times)