The exploration of longevity and its intersection with technology, investment, and healthcare has sparked significant interest across various sectors.

Investors, researchers, and consumers alike are increasingly recognizing the potential of longevity technologies to not only extend life but improve the quality of health throughout aging.

This edition of our newsletter delves into three pivotal articles that highlight the diverse perspectives and emerging trends within the longevity market – from the investor’s outlook on longevity tech as a long-term play, to global investor attitudes towards a century-long life, and the unfolding potential of advanced therapeutics in human longevity.

This analysis aims to provide our readers with a comprehensive understanding of the strategic importance of longevity investments, the evolving consumer attitudes towards health and wealth, and the technological advancements driving the future of this industry.

As we explore these themes, we will uncover the implications for the market, highlight investment opportunities, and discuss the challenges faced by stakeholders in aligning economic incentives with health outcomes.

5 investors explain why longevity tech is a long-term play

The featured article delves into the perspectives of five seasoned investors who are actively shaping the future of longevity technology.

It highlights their unified view that longevity tech is not merely a speculative venture but a significant, enduring investment opportunity poised to transform our understanding and management of aging.

The conversation begins with a general consensus among the investors that the public’s perception of longevity needs a fundamental shift. The common misconception that longevity equates to prolonged frailty is dispelled by emphasizing the industry’s goal to enhance not only the lifespan but more importantly, the healthspan—the period of life spent in good health. This redefinition is crucial as it aligns with the broader ambitions of longevity technology to delay the onset of age-related diseases, thereby improving quality of life.

Tech Crunch

Investors Nathan Cheng and Sebastian Brunemeier of Healthspan Capital argue that the science behind longevity has reached a point where reversing aging is not just a fantasy but a reality within reach, at least in animal models.

They stress that the transition from treating symptoms to addressing the root causes of aging – akin to the preventive approach in healthcare – can fundamentally alter medical practice and health outcomes.

The potential for a high return on investment remains a strong allure, with the promise of a burgeoning market as these technologies prove effective and gain regulatory approval.

Moreover, the article draws parallels between the nascent stage of longevity tech and the early days of the fintech revolution, suggesting a similar trajectory of growth and integration into everyday life.

Investors are looking for diverse applications of longevity technologies, ranging from biotech solutions to wellness and preventive measures, highlighting the sector’s vast scope.In essence, the article presents a compelling narrative that longevity tech is a prudent long-term play with multifaceted benefits.

Read the full article here.

The Century Club

UBS Investor Watch explores the perceptions and attitudes of wealthy investors worldwide regarding longevity and their prospects of living to 100 years.

The comprehensive survey included more than 5,000 investors across various countries, offering a unique glimpse into the interconnected realms of wealth, health, and long-term life expectancy.

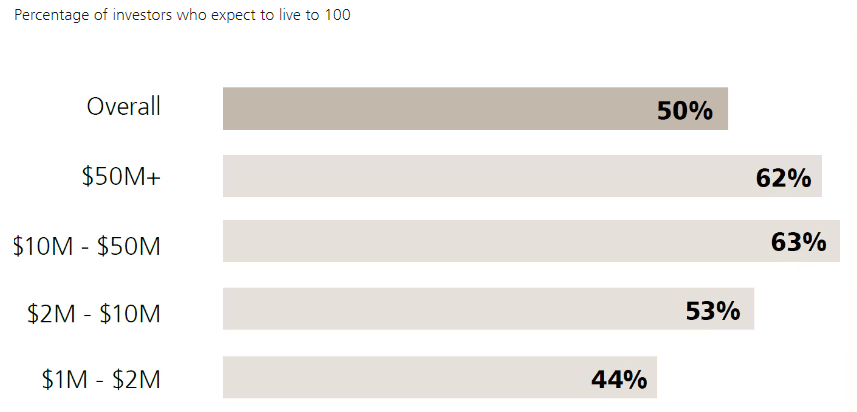

Key findings from the survey reveal that more than half of the wealthy investors harbor expectations of living up to or beyond 100 years, though this anticipation varies significantly by region.

For instance, a notable 75% of German investors expect to reach this milestone, contrasting sharply with less than a third of U.S. investors. These differences are reflective not only of the diverse healthcare systems and lifestyle habits across these regions but also of cultural attitudes towards aging and longevity.

UBS

Health emerges as a paramount concern for these investors, transcending even wealth in terms of importance.

An overwhelming majority believe that their financial status enables them to maintain better health, illustrating a direct link between wealth and access to health resources. This is further emphasized by the substantial investments they make in healthcare and wellness services, ranging from preventive measures like gym memberships to direct medical care.

Investors are responding to these longevity challenges by adjusting their financial strategies. This includes shifting investment portfolios towards more long-term, stable assets and revising legacy plans to accommodate potentially longer lives.

Interestingly, there is a trend among investors to begin distributing their wealth during their lifetime, a strategy influenced by the desire to witness the enjoyment and utilization of their assets by their heirs.

As longevity continues to capture the interest of the wealthy, the insights derived from their behaviors and attitudes provide valuable lessons for public health strategies and financial planning, emphasizing the need for a holistic approach to managing longevity in society.

Read the full article here.

How valuable is the global longevity market?

The third article, authored by Dr. Thomas Solbach and Christin Zündorf, delves into the rapidly evolving field of longevity therapeutics, an area that stands at the confluence of pharmaceutical innovation and biotechnological advancement.

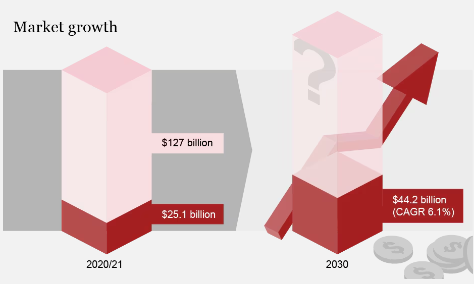

The article begins by highlighting the global market potential for longevity therapeutics, which, according to the authors, transcends the existing market for anti-senescence therapies valued at $25.1 billion in 2020.

With projections suggesting growth to $44.2 billion by 2030, the authors argue that these figures only scratch the surface of what could be achieved if longevity therapeutics begin to replace conventional treatments for age-related diseases.

PwC Strategy&

This shift is driven by a deeper understanding of aging as the root cause of many chronic conditions, including cardiovascular diseases, Type 2 diabetes, and Alzheimer’s disease.

Dr. Solbach and Ms. Zündorf explore several key drivers of growth in the longevity therapeutics sector. Among these, regulatory approval emerges as a critical accelerator.

Currently, aging is not recognized as a disease by major health regulators, which impedes the development and commercialization of anti-aging products. Recognition would not only unlock public funding but also facilitate a surge in investment and research aimed at developing effective and safe longevity treatments.

Overall, this article presents a compelling vision of the future of longevity therapeutics, underscored by a mix of optimism for the technological and scientific progress and a cautious approach to the socio-economic and ethical challenges that accompany such ground-breaking advancements.

Read the full article here.

Final Thoughts

From investment trends and market readiness to public perception and regulatory environments, each element plays a crucial role in shaping the future of longevity.

The longevity market is poised for significant expansion, with technologies that promise to revolutionize how we approach health and aging. Investors are increasingly aware of the long-term nature of these investments, paralleling the slow yet impactful progression of longevity tech from concept to market reality.

As the sector continues to evolve, it will be imperative to foster an ecosystem that supports innovation while addressing ethical, regulatory, and access-related challenges.

The potential for longevity technologies to extend healthy lifespans is immense, but achieving widespread acceptance and integration into healthcare systems globally will require concerted efforts from investors, researchers, policymakers, and the public.

“Aging is the largest single risk factor for virtually every significant human disease. Think of it this way: if you can heal aging, you can heal disease.”

James Peyer

Top Longevity Reads

- Longevity: Insurers’ biggest growth opportunity? (Scor)

- Is Longevity The Health Revolution We So Desperately Need? (Hillary Lin, M.D.)

- Where Will Older Adults Live? (Morgan Stanley)