As demographic trends shift and populations age, the market is poised for significant growth, fueled by the demand for solutions that extend healthspan and address age-related challenges.

Several key factors are driving the longevity market’s growth. Firstly, advancements in biotechnology and AI have significantly improved our understanding of aging and its underlying mechanisms. This has led to the development of targeted therapies and personalized medicine approaches, enabling more effective interventions in age-related diseases and conditions. The convergence of biotechnology and AI is unlocking new possibilities for drug discovery and development, with companies leveraging these technologies to create novel therapeutics and interventions.

Secondly, demographic shifts are creating new challenges and opportunities for the longevity market. As populations age, there is a growing demand for solutions that enhance quality of life and address the health issues associated with aging. This demographic trend is particularly pronounced in developed countries, where aging populations are increasing healthcare costs and straining existing systems. The longevity market offers potential solutions to these challenges, with innovations in areas such as regenerative medicine, senescence research, and age-related disease prevention.

Within the longevity market, several strategic opportunities are emerging for investors, entrepreneurs, and scientists. One key area of focus is the development of therapeutics that target the underlying mechanisms of aging. Companies in this space are conducting clinical trials to evaluate the effectiveness of novel drugs and interventions, with the potential to significantly impact age-related diseases and conditions. Investors are particularly interested in companies that are developing therapeutics with clear pathways to clinical trials, as this provides a strong investment case and potential for significant returns.

Another area of opportunity is the development of personalized medicine approaches to aging and healthspan. Advances in genomics, proteomics, and metabolomics are enabling more tailored interventions and treatments, with the potential to significantly enhance health outcomes and quality of life. Companies in this space are leveraging AI and data analytics to develop personalized interventions, with applications in areas such as longevity, wellness, and disease prevention.

The growth of the longevity market has significant implications for the broader healthcare and biotech industries. The focus on extending healthspan and addressing age-related challenges is reshaping healthcare delivery, with an emphasis on preventive care and personalized interventions.

This shift is creating new opportunities for companies that are developing innovative solutions and technologies, as well as for investors who are looking to capitalize on this growing market.

Longevity biotech a lucrative market for investors

The longevity biotech market is rapidly becoming a lucrative sector for investors, entrepreneurs, and scientists. As highlighted by Opalesque, the industry, estimated to be worth $26.5 trillion, is burgeoning with over 50,000 companies, 10,000 investors, and 1,000 research and development centers. The sector’s focus on addressing aging-related health issues presents a critical opportunity to improve health expectancy alongside life expectancy.

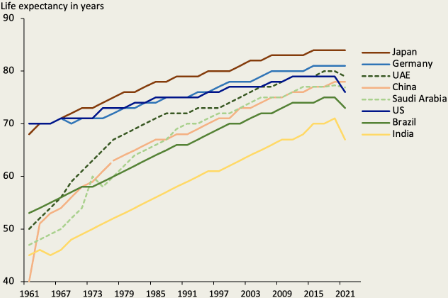

Modern advancements have increased life expectancy worldwide, but health expectancy has lagged, resulting in prolonged periods of chronic diseases in later life. Longevity biotechnology, as outlined by BioAge Labs’ CEO Kristen Fortney, aims to develop drugs targeting aging as a root cause of disease, aligning with the United Nations’ Decade of Healthy Ageing initiative.

The sector presents numerous investment opportunities, particularly in companies focused on developing therapeutics that target the mechanistic drivers of aging and conduct clinical trials. As noted by James Peyer, CEO of Cambrian Bio, clinical trials targeting existing diseases provide a robust investment case, with longevity applications as an added benefit. Investors are advised to focus on growth-stage companies poised for clinical trials, avoiding supplement producers or companies claiming aging as a disease.

Opalesque

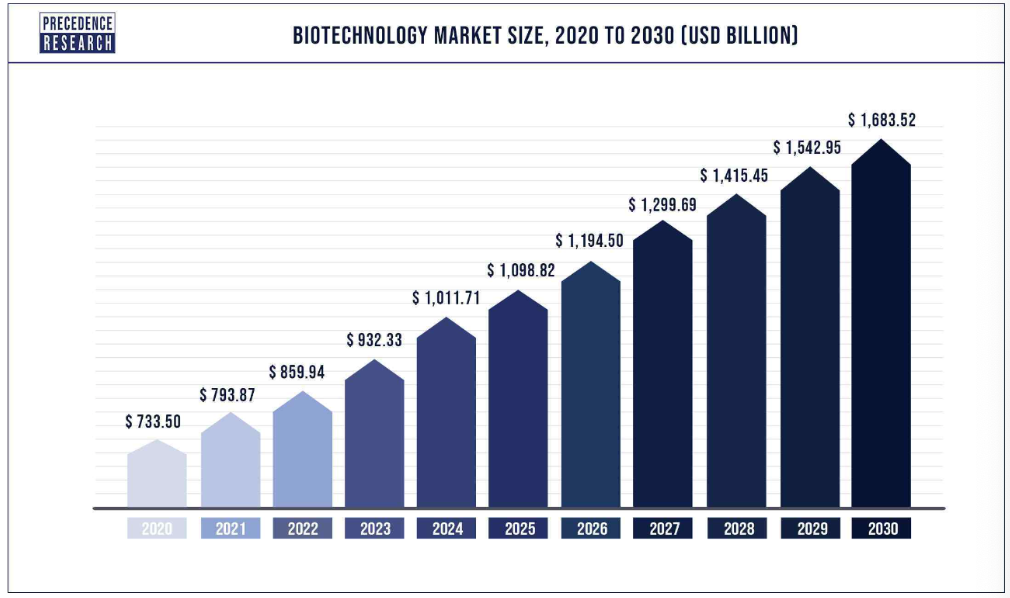

The longevity industry, still in its early stages, is poised for substantial growth, with some analysts predicting it could become the largest investment opportunity of the coming decades. The global biotechnology market, valued at $860 billion in 2022, is projected to grow at a CAGR of 8.7% through 2030, with North America as the largest market and Asia Pacific as the fastest-growing region. The sector’s resilience, even amid market challenges, underscores its potential as a lucrative investment domain.

The webinar “Longevity Biotech: Investing in a Healthier Future” offers insights into this evolving ecosystem, featuring experts like Robin Lauber, Davide Ottolini, and James Peyer, who discuss the sector’s investment potential and strategies for navigating this dynamic industry.

Read the full article here.

The startup that wants to cure diseases and slow aging, with the help of AI

Extended longevity is a captivating topic, with increasing life expectancy worldwide shaping diverse investment opportunities. As explored by Dr. Damien Ng from Julius Baer, key business segments underpinning this trend include healthcare, elderly care, beauty, leisure, nutrition, and financial planning.

The world is aging, and as life expectancy rises, so does the prevalence of chronic diseases. Healthcare, particularly for age-related conditions like Alzheimer’s, cancer, and diabetes, is becoming increasingly important. The demand for elderly care is also growing, driven by shifting social trends and increasing dependency ratios.

The beauty industry, valued at $420 billion, thrives on consumers’ desire to look their best, while the leisure industry benefits from older adults’ discretionary income. Nutrition, particularly supplements, addresses deficiencies faced by older adults, and financial planning is crucial for retirement preparation.

Semafor

Investment opportunities in longevity reflect unique demographic portraits. Developed countries like Japan, Germany, and Italy have higher median ages, while affluent nations like Saudi Arabia, Singapore, and the UAE maintain lower median ages. The obesity epidemic, affecting 650 million people, and hypertension, impacting 1.3 billion, highlight the importance of healthy lifestyles and potential investment areas in healthcare and wellness.

Adopting healthy habits like exercise, better diet, and community engagement can extend lifespan, mirroring the centenarians in the Blue Zones. These habits, along with products and services, present investment opportunities across sectors, including healthcare, elderly care, beauty, leisure, nutrition, and financial planning, reflecting the long-term structural trend of changing demographics and lifestyles.

Read the full article here.

Key business segments underpinning longevity

Insilico Medicine, a biotech startup, is at the forefront of using artificial intelligence (AI) to discover treatments for diseases and extend human life. The company, led by CEO Alex Zhavoronkov, focuses on developing hyper-targeted drugs and inhibiting cells associated with aging.

Insilico Medicine leverages AI to discover new drug candidates, as seen with its potential treatment for idiopathic pulmonary fibrosis. The company’s computational biology approach is accelerating innovation in biotech, with AI-driven treatments also being developed for breast cancer and other diseases.

AI’s precision allows for targeted treatments, and Insilico’s global head of AI platforms, Petrina Kamya, demonstrated how the company uses AlphaFold, an AI project, to generate potential drugs on a computer. This approach enables rapid drug discovery, with Insilico earning millions in licensing fees from small molecule drug candidates for various conditions.

Omnia Health

Zhavoronkov envisions AI-enabled precision medicine extending human lifespan and reducing human suffering. Insilico’s technology, used in countries like the UAE, could enable bespoke drugs for specific populations, transforming healthcare. However, the potential for misuse, such as creating bioweapons, highlights the need for responsible AI development.

China’s role in enabling drug research through contract research organizations demonstrates AI’s potential to democratize early-stage drug discovery. This trend could lead to increased domestic drug creation within China and other countries, reflecting the transformative impact of AI on global health and longevity.

Read the full article here.

Final Thoughts

The longevity market is poised at the intersection of groundbreaking advancements in biotechnology, artificial intelligence, and healthcare, offering a promising landscape for strategic investments and innovation. The convergence of these disciplines is reshaping how we understand and approach aging, leading to new therapeutic interventions and personalized health solutions that have the potential to significantly enhance quality of life.

One of the key takeaways from our analysis is the robust growth potential of the longevity market. As the global population ages, the demand for interventions that enhance healthspan and address age-related conditions is expected to rise. This trend presents a unique opportunity for companies and investors focused on developing therapeutics and technologies that target the underlying mechanisms of aging. The rapid advancements in biotechnology and AI are accelerating innovation in this sector, opening up new possibilities for disease prevention, regenerative medicine, and personalized health solutions.

From a strategic perspective, the longevity market offers diverse opportunities across multiple sectors. Investors should be particularly attentive to companies that are conducting clinical trials for novel therapeutics and developing personalized medicine approaches, as these areas are likely to see significant growth and returns. Additionally, the emphasis on extending healthspan aligns with broader healthcare trends towards preventive care and wellness, highlighting the potential for innovative solutions that enhance quality of life and reduce healthcare costs.

Looking ahead, the longevity market is set to play a critical role in shaping the future of healthcare and innovation. The industry’s focus on holistic approaches to aging and healthspan is reshaping consumer behavior, healthcare delivery, and investment strategies, with broad implications for global markets and societal well-being. By understanding the key drivers and strategic opportunities within this market, stakeholders can position themselves to capitalize on the dynamic and evolving landscape of longevity.

“It is not how old you are, but how you are old.”

Jules Renard

Top Longevity Reads

- Longevity: Insurers’ biggest growth opportunity? (Scor)

- Is Longevity The Health Revolution We So Desperately Need? (Hillary Lin, M.D.)

- Where Will Older Adults Live? (Morgan Stanley)